After an accident, Insurance adjusters don’t play fair. Know what to expect, and don’t fall for their tricks.

In a perfect world, insurance companies would simply pay victims what they’re owed following a serious car accident. Unfortunately, insurance adjusters often unfairly deny claims, blatantly lie to claimants, and will use every trick in the book to skirt liability.

If you’ve been injured in a car accident, the most important thing you can do is file a claim with the insurance company and then speak to an attorney. Most of us have dealt with the insurance claims process before, but understand that your personal injury claim (which is separate from your property damage claim) will be heavily scrutinized by the insurance adjuster.

Filing your claim is only the beginning of the process. Without an attorney handling your case, you are almost guaranteed to face a drawn out, one-sided battle with the insurance company. While they may try to offer you a settlement before you even know the full extent of your medical expenses and other damages, they only do this for their own benefit. They may tell you that you don’t need an attorney because they’ve already accepted liability, only to later (months down the line) reverse course and claim that you were partially—or fully to blame.

Victims of car accidents are essentially at the mercy of the claims adjuster. If the adjuster won’t offer a fair settlement or unfairly denies your claim, your only option is to file a lawsuit. Adjusters know that people are often hesitant to hire an attorney (even though personal injury lawyers work on a no-win no-fee basis), and unfortunately this works to their advantage.

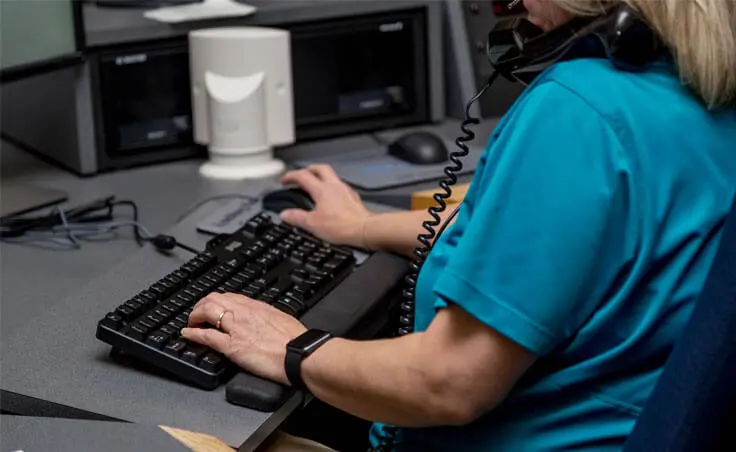

Claims adjusters spend most of their day investigating insurance claims by collecting statements, consulting police and hospital records, inspecting property damage, and looking at how similar claims have played out in the past. The only thing is, they’re only looking at it from one side. Their ONLY goal is to save the insurance company money by paying out as little as possible on every single claim.

You would think that a claims adjuster would be required to look at the accident from an objective point of view (or at least follow some set of official guidelines) before denying a claim, but that’s simply not the case. There is no law that requires insurance companies to pay out on ANY claim unless a settlement agreement has been made (and signed) or they’re compelled to do so by a court order.

This rest of this article will dive into some of the most-common tricks, lies, and shady tactics that claims adjusters and insurance companies employ, as well as how best to avoid them.

Contact Our Dallas Car Accident Lawyers Today

Can Insurance Adjusters Lie to You?

Yes, insurance adjusters are allowed to lie to you. In fact, many are even encouraged to do so. An adjuster might tell you that their driver is not liable for the accident when they know that they are. They may claim that they can’t contact the other driver for weeks on end — or that they’re “still investigating” two months in… They’ll sometimes even tell you that they’re accepting full responsibility up front, only to put 50 percent of the blame back onto you when you’re done treating and ready to settle.

The truth is that without an attorney, the insurance company sees you as an easy target. They’ve defended thousands of cases just like yours, and they know every trick in the book. As someone who deals with insurance companies on a daily basis myself, I strongly advise that you take everything they say with a grain of salt. Be extra skeptical, and never agree to anything regarding your personal injury claim without discussing you case with an attorney first.

Scouring Your Social Media Accounts

It’s surprisingly common nowadays for insurance companies to delve into your social media accounts and online activity simply because you filed a claim. Make no mistake, the only reason they’re looking through your Facebook profile or Twitter feed is to find dirt they can use to potentially weaken or otherwise lower the value of your claim.

If you post a status update telling friends and family that you’re “feeling okay” following your car accident, they’ll use this statement in order to deny your entire injury claim. If you post a dance video on TikTok, same deal. Have you previously commented about an accident or injury in the past? They’ll claim that your current injuries are related. Have you ever taken a photo or video while driving and posted it to Instagram? They could even use that to claim you’re an unsafe driver and likely shared fault for the crash.

Making a Recorded Statement

When someone files a car accident injury claim, the insurance company will ask the claimant and/or policy holder to provide a brief recorded statement over the phone detailing the facts of accident and how it occurred. They’ll often say that giving them a recorded statement will speed up the claims process. In reality, they’re only hoping to lock you into a statement in order to potentially use your own words against you later.

Making a recorded statement at this point of your claim is not in your best interests for many reasons. If all the facts are not readily available (or are still unclear) to you, then you may very well make a seemingly-innocent comment that can jeopardize your entire claim. What if you forget a fact or later discover pertinent information that fundamentally changes your frame of reference?

Additionally, you may not have a full understanding of the extent of your injuries at this point. Some types of injuries (e.g., whiplash, soft tissue injuries, internal damage, etc.) can take days or weeks to present themselves—especially if you have other significant or overlapping injuries. For example, what may initially seem like a sprained knee could eventually reveal itself as a permanent disability.

When you do make a recorded statement to the insurance company, you want to ensure that you are honest and forthcoming at all times—but stick to the facts! You do not need to answer personal questions, discuss your medical treatment to this point, or opine on any facts of the case that you are not 100% sure of. The best thing you can do is speak to an attorney before making any statements, and have them advise you on how to best move forward.

Issues of Liability

The biggest part of any car accident injury claim is liability, which is the first thing that the insurance company will look at. Did their driver miss a payment on their policy? No liability; Claim denied. Was the collision caused by anything other than their driver’s negligence? Claim denied. Could it be argued that the collision was an intentional act? Denied. Could it be argued (even if a stretch) that both parties are equally to blame? Easy deny.

The thing is, insurance companies don’t owe you anything if their driver wasn’t at least 51% at fault for the accident, and any percentage of liability that they can place onto you reduces their overall liability. Even in cases where it’s obvious that their driver was 100% to blame, the insurance company will almost always claim that you failed to take preventative measures and thus share in liability—even if that assessment is completely unfounded. This is a very common tactic used by insurance companies in an attempt to unfairly reduce the value of your claim.

How To Scare an Insurance Adjuster

The only way to truly scare an insurance adjuster is to hire an attorney. I know it’s probably not what you want to hear, but the unfortunate truth is that insurance companies hold all the leverage when it comes to a car accident injury claim. During the claims process, the insurance company controls everything. They get to decide who’s at fault, how much your injuries are worth, whether or not to extend a settlement offer, what that offer is—and they can take as much time as they please.

Insurance companies know that unless you have an attorney willing to take them to court, they have the ultimate authority when it comes to your claim. You can threaten to sue all you want, but the insurance company has no reason to take these threats seriously until an attorney sends them a letter of representation on your behalf. That’s the point in which they begin to take your claim seriously.

Low-Ball Settlement Offers

Insurance companies will never offer an unrepresented claimant the full value of their claim. It’s just not in the best interests of the insurance company to pay a dollar more than they can get away with, even when it’s the decent thing to do. If you’re being offered a settlement, it’s going to be at an amount that favors them.

If they can get you to settle, you waive all rights to pursue any additional compensation later. If you accept a settlement offer early on and later discover that your damages are much higher than you originally thought, guess what? They don’t owe you a penny more than what you previously settled for. This happens all the time, and is why you shouldn’t even entertain the idea of a settlement before you have completely finished treatment.

If you’re eventually given a low ball settlement offer by the insurance company, there are ways to fight back. The unfortunate truth is that without an attorney handling your claim, you’re simply at the mercy of the insurance company. Technically speaking, they’re under no legal obligation to pay out on any claim unless compelled to do so by court order.

Insurance companies know that victims are in a tough spot after an accident, and will use this to their advantage. Many accident victims end up accepting a settlement worth a mere fraction of what they’re truly owed simply because they’re tired of fighting—or because they don’t realize that a personal injury attorney can fight the insurance company for them at no out of pocket cost.

Why You Should Consider Hiring an Attorney

Has the insurance company unfairly denied your claim? Has the insurance adjuster lied to you? At Montgomery Law, we’ve been around the block a time or two and know how to deal with these underhanded tactics. We won’t let the insurance company dictate the process, and will fight for every penny you deserve. Consultations are always free, and we never charge attorneys fees unless (and until) we win.

If you have questions, we’re happy to answer them for you. If you’d like to have us review your case and determine whether or not we can help, contact us today at 214-720-6090 (local) or 1-833-720-6090 (toll-free), or send us an email directly from our website. The earlier we can get started on your claim, the better chance you’ll have at recovering the compensation you’re truly owed.

Montgomery Law is a Dallas-based personal injury law firm focused on getting clients the justice and compensation they deserve.

Call us toll-free at 1-833-720-6090 to discuss your case today for no cost.

My car damaged by neighbor. He lied go police and then admitted culpabiliy. His insurance will not pay

This what my adjuster said to when I asked for files and emails from a conversation in which my adjuster, the contractor and I were in a conversation about repairs to my property.

Can they do this:

As to your request for file notes, we do not disclose copies of file log notes as these are considered proprietary. However, we are most happy to provide you with any additional details about our actions in resolving your claim.